A sharp fall in a fundamentally strong stock always sparks debate—and the recent decline in Kaynes Tech share price, which dropped more than 7% in a single trading session, is no exception. The fall came immediately after a company announcement that revised forward revenue expectations, triggering a wave of selling across market participants.

For many retail investors, such a move naturally raises concern. A one-day fall of this magnitude often feels like a warning signal. But seasoned investors know that markets often react faster than fundamentals change. To understand whether this move represents genuine business risk or a temporary reset of expectations, one must look beyond the price chart.

This article breaks down the event in detail—examining the business model, financial specifications, market psychology, expert strategies, and long-term implications for Kaynes Technology.

Kaynes Technology India Limited: A Deeper Look at the Business

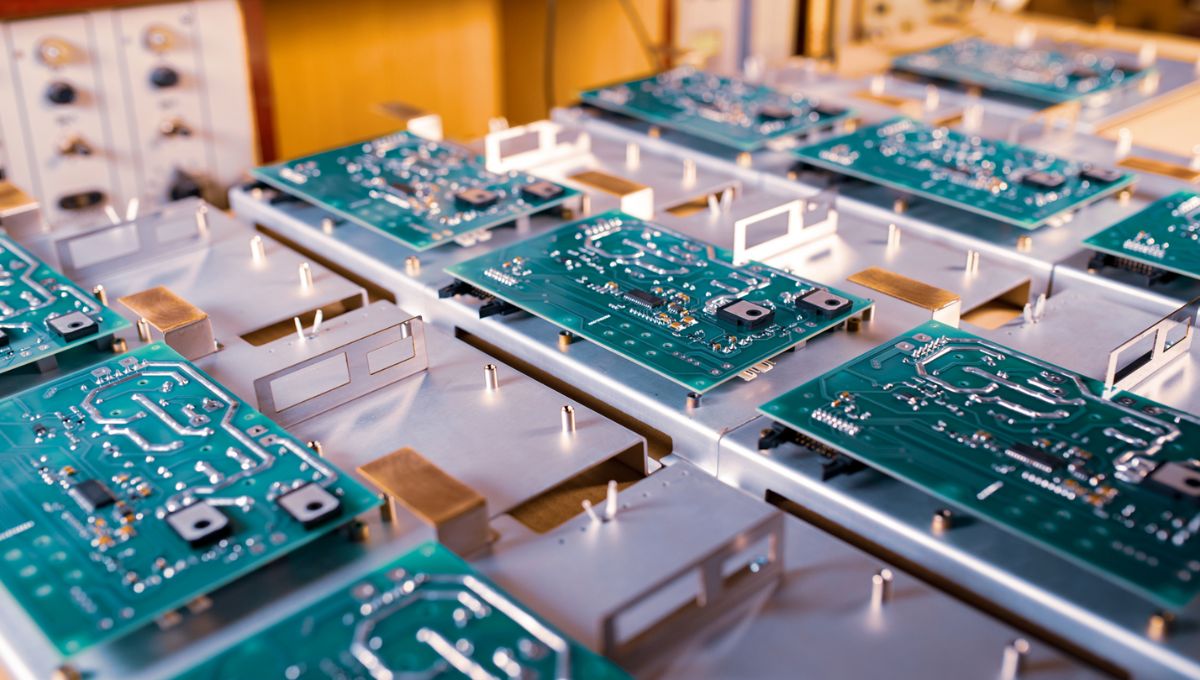

Kaynes Technology India Limited operates in the Electronics System Design and Manufacturing (ESDM) space, a sector that has gained strategic importance in India’s industrial growth story.

Unlike commodity manufacturers, Kaynes focuses on complex and regulated electronic systems, where execution capability, quality standards, and long-term client trust matter more than sheer scale.

What Makes the Company Different?

Kaynes Technology offers:

- Product conceptualisation and electronic design

- Prototyping and validation

- Precision manufacturing and assembly

- Testing, certification, and lifecycle services

This end-to-end capability allows the company to participate across the product lifecycle rather than competing only on manufacturing cost.

Sector Exposure and Revenue Mix

The company’s revenue is spread across multiple high-value sectors:

- Automotive electronics, including EV-related components

- Industrial automation and power electronics

- Railways and infrastructure systems

- Aerospace and defence electronics

- Medical and IoT-enabled devices

This diversification reduces cyclicality and provides resilience during sector-specific slowdowns.

The Announcement That Changed Market Sentiment

The trigger for the fall in Kaynes Tech share price was a revision in revenue guidance for the upcoming financial year. Management communicated a more cautious outlook, reflecting execution timelines and prudent planning rather than aggressive projections.

What the Announcement Actually Signaled?

- Moderation in near-term growth expectations

- Emphasis on execution quality over speed

- Conservative planning amid global demand uncertainty

Importantly, the announcement did not point to operational stress, margin erosion, or balance-sheet weakness.

Why Did the Market React So Strongly?

Expectations Were Already Priced In

Before the announcement, Kaynes Tech was trading at valuations that assumed strong and consistent growth. When expectations are elevated, even modest guidance changes can trigger disproportionate reactions.

Retail Participation Amplified Volatility

High retail involvement tends to increase short-term volatility. As prices started falling, fear-driven selling and stop-loss triggers intensified the decline.

Technical Breakdown: Accelerated Selling

Once key support levels were breached, algorithmic and momentum-based trades further accelerated the downside.

The result was a sharp, sentiment-driven correction rather than a fundamentals-driven collapse.

Kaynes Tech Share Price: Business and Financial Specifications

Core Business Specifications

| Specification | Details |

| Industry | Electronics Manufacturing Services |

| Business Model | Integrated ESDM |

| Manufacturing Focus | High-mix, complex electronics |

| Client Profile | Long-term, regulated sectors |

| Entry Barriers | High |

Financial Health Specifications

| Metric | Current Status |

| Revenue Growth | Positive, moderated |

| Operating Margins | Stable |

| Debt Levels | Low |

| Cash Flow | Healthy |

| Order Book | Strong visibility |

These specifications suggest that the company’s operational foundation remains stable, despite near-term uncertainty.

How Experienced Investors Are Reading the Situation?

Institutional Investors: No Signs of Panic

Large investors typically avoid reacting to single announcements. Instead, they reassess assumptions and wait for confirmation through quarterly performance and execution data.

Long-Term Investors: Reviewing, Not Exiting

Veteran investors are focusing on:

- Order inflow momentum

- Execution timelines

- Margin sustainability

Rather than abandoning the stock, many are revisiting valuation comfort levels.

Short-Term Traders: Managing Risk

Traders are treating the stock as a volatility play rather than a directional bet, keeping position sizes controlled.

Why Conservative Guidance Can Be a Strategic Choice?

In manufacturing businesses, overly aggressive guidance often leads to:

- Execution pressure

- Margin compromise

- Loss of credibility

Conservative guidance, while unpopular in the short term, can:

- Improve delivery reliability

- Reduce earnings volatility

- Strengthen long-term trust with investors

Markets may punish caution initially, but disciplined execution often changes sentiment over time.

Industry Tailwinds Still Work in Kaynes Tech’s Favour

Several structural trends continue to support the company’s long-term prospects:

- Government focus on domestic electronics manufacturing

- Import substitution in high-value electronic systems

- Growing complexity of electronics in EVs and automation

- Increased localisation by global OEMs

These tailwinds remain unaffected by the recent guidance revision.

Read more:- Google Pixel 10a Confirmed: Pre-Orders Begin February 18 With India on Google’s Priority List

Risks That Investors Should Acknowledge

Balanced analysis requires acknowledging potential risks.

Key Risk Areas

- Execution delays in large or complex projects

- Margin pressure due to input cost inflation

- Valuation sensitivity if growth slows further

Being aware of these risks allows investors to position themselves realistically rather than emotionally.

What Happens Next for Kaynes Tech Share Price?

Short-Term Scenario

- Continued volatility is likely

- Price movement may remain news-driven

- Market sentiment could stay cautious

Medium to Long-Term Scenario

- Execution performance will be decisive

- Order book conversion and margins will matter most

- Fundamentals will ultimately outweigh sentiment

Historically, strong manufacturing companies tend to recover once execution visibility improves.

Investor Perspective: Reaction vs Reason

The recent fall in Kaynes Tech share price highlights a familiar market pattern—expectations adjust faster than businesses change. While the correction reflects disappointment, it does not automatically signal long-term deterioration.

For informed investors, this phase is about patience, discipline, and close monitoring—not fear-driven decisions.

The decline in Kaynes Tech share price appears to be an expectation reset rather than a fundamental warning. The company continues to operate in a structurally strong sector with stable financials and diversified exposure.

Markets may remain volatile in the short term, but long-term value creation will depend on execution, not headlines.

FAQs

What caused the sharp fall in Kaynes Tech share price?

The stock declined after management revised its forward revenue guidance, leading to short-term disappointment.

Does this mean Kaynes Technology is struggling?

No. The company remains financially stable with healthy margins and a strong order book.

Should long-term investors be concerned?

Long-term investors should focus on execution and fundamentals rather than short-term price movements.

Is this correction an opportunity or a risk?

It depends on individual risk appetite. Experts suggest a staggered, disciplined approach.